M&M Results Q3 F24 and nine months F24

Brand

Q3 Consolidated PAT up 34% (excl. PY Susten gain and Trucks impairment)

$ Bolero Max Pickup 2T variant has been classified under LCV 2-3.5T. In SIAM it is classified under LCV 3.5 to 7.5T, since its GVW is slightly higher than 3.5T)

Mumbai, February 14, 2024: The Board of Directors of Mahindra & Mahindra Limited today approved the financial results for the quarter and nine month ended December 31, 2023 of the Company and the consolidated Mahindra Group.

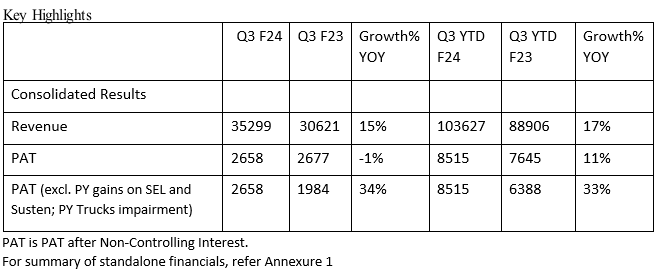

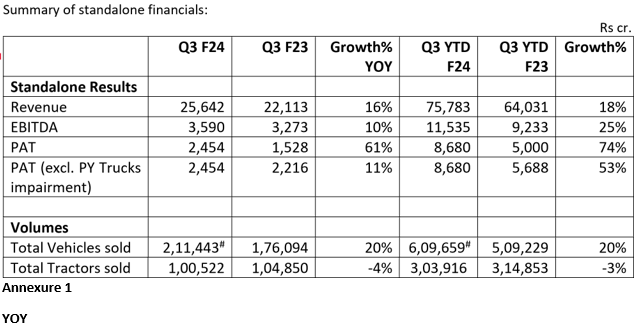

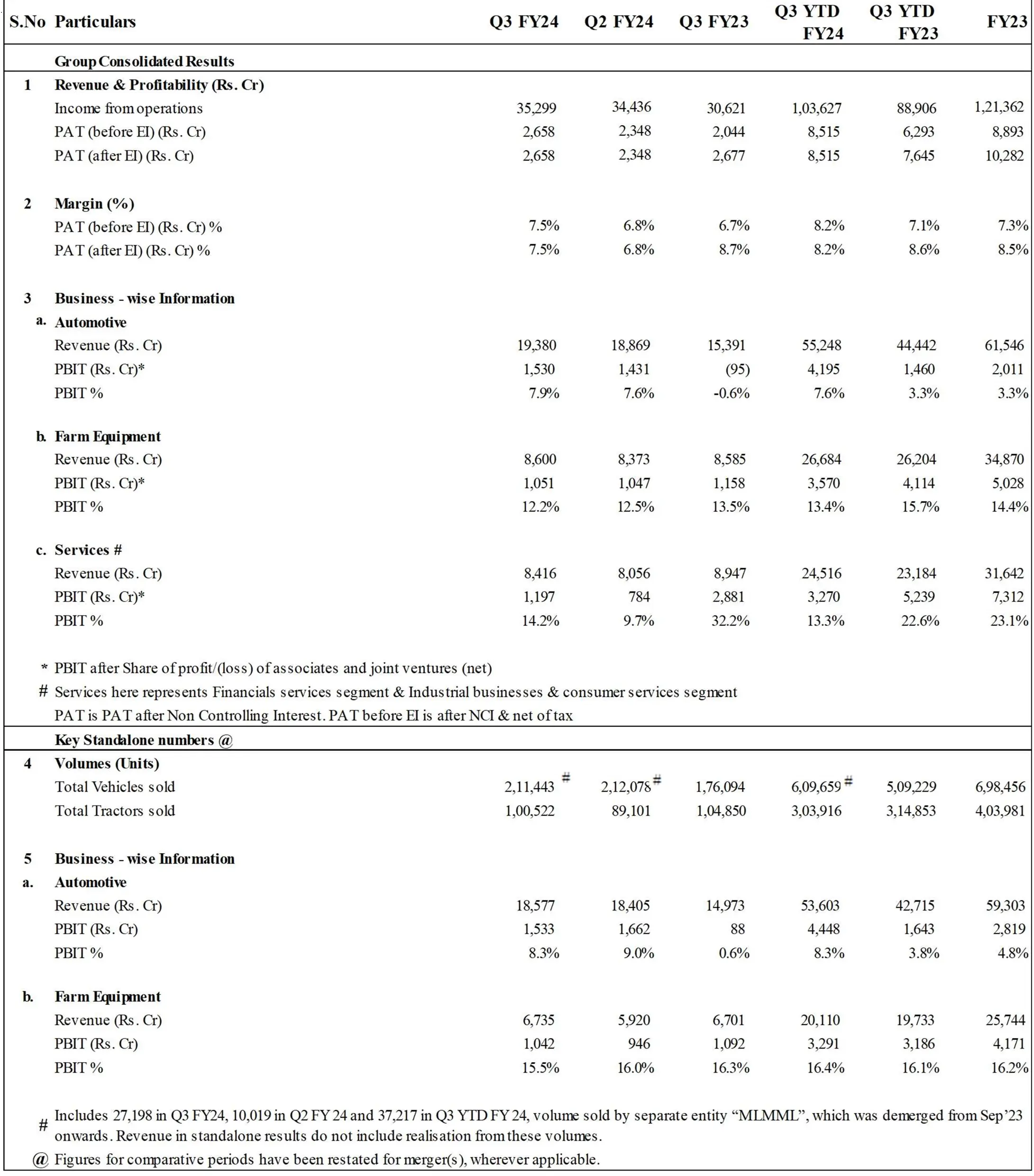

Key financials:

Mahindra & Mahindra Group delivered solid operating performance across all businesses, except TechM. Auto continues to gain market share. Farm market share improves despite decline in Industry. Financial services continues its strong performance on asset quality with record low GS3. Growth gems progressing well on 5X challenge with a notable milestone achieved at Susten with listing of India’s largest renewable InvIT. Consolidated PAT at ₹ 2658 Crore, up 34% Q3; up 33% YTD (excl. PY gains on SEL and Susten; PY Trucks impairment).

Auto

Farm

Services

Commenting on Q3 and YTD F24 performance

Dr. Anish Shah, Managing Director & CEO, M&M Ltd. said, “Our businesses have delivered a solid operating performance this quarter. Auto continues to gain market share and grew rapidly to double its profit. Farm has gained market share despite tough market conditions. In Services, MMFSL had its lowest ever GS3 and credit costs are trending as per guidance. TechM is working through challenging operating results but I feel good that the right actions are being taken to turnaround its performance. We continued the journey of unlocking value in our growth gems with the listing of India’s largest renewable InvIT and partnerships with marquee investors.”

Rajesh Jejurikar, Executive Director & CEO (Auto and Farm Sector), M&M Ltd. said, “We had a strong quarter for both Auto and Farm businesses. We were #1 in SUVs with Revenue Market Share of 21% in Q3 while further improving our Auto Standalone PBIT margins. We increased tractor market share by 80 bps to 41.8% in Q3 even as the Tractor industry contracted on back of last year’s high base, weather vagaries and lower reservoir levels. Our E-3W business is maintaining its market leadership with Q3 market share of 54% and YTD market share of 59.5%”

Manoj Bhat, Group Chief Financial Officer, M&M Ltd. said, “We continue to meet our objectives of 18% RoE and value creation from capital allocation actions. It has been a good quarter with multiple business showing growth momentum.”

# Includes 27198 in Q3 F24 and 37,217 in YTD F24 vol. sold by separate entity “MLMML”, which was demerged from Sep’23 onwards. Revenue in standalone results do not include realisation from these volumes.

Disclaimer:

All statements included or incorporated by reference in this media release, other than statements or characterisations of historical fact, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management's beliefs and certain assumptions made by us. Although M&M believes that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which such statement was made, and M&M undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. No assurance can be given that actual results, performance or achievement expressed in, or implied by, forward looking statements within this disclosure will occur, or if they do, that any benefits may be derived from them.

Search Assistance

Welcome!

Mahindra Assistant is here to help with your search queries. How can we assist you today?