Mahindra Finance launches Special Deposit Schemes for digitally affluent customers

Brand

- Special Deposit Schemes to carry 20 bps higher interest rates per annum

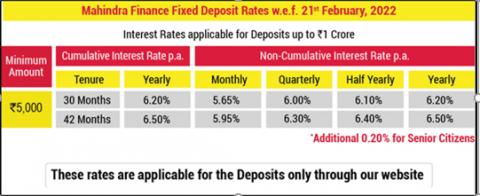

- Deposits for 30 & 42 months to offer 6.20% and 6.50% interest rates respectively

- Scheme keeping with the company’s Digitisation initiatives

Mumbai, February 23, 2022: Mahindra Financial Services Limited (Mahindra Finance), part of the Mahindra Group, and one of India’s leading non-banking finance companies focused on rural and semi-urban sector, today announced the launch of a Special Deposit Scheme. This scheme, aimed specifically for digitally affluent customers is part of the company’s Digitisation drive.

In keeping with today’s digital world, depositors have an opportunity to interact directly with the deposit taking companies for placement of deposits. To leverage this opportunity, Mahindra Finance is announcing an innovative scheme that will offer 20 bps higher interest rates per annum on direct deposits. This scheme is in addition to prevailing deposit schemes which the company is already offering to its customers.

Vivek Karve, Chief Financial Officer, Mahindra Finance said: “The launch of this special deposit schemes is in accordance with our larger vision of offering multiple financial/ investment instruments through digital mode. Mahindra Finance’s fixed deposit schemes are FAAA rated by CRISIL, the credit rating that indicates Highest Safety”.

The company will offer this Special Deposit Schemes through digital mode to depositors via the company website https://www.mahindrafinance.com/ for investment. With various digitised and automation backend processes, Mahindra Finance is confident of providing a seamless experience to its deposit holders. Under these schemes, the depositors can place their deposits for a tenure of 30 and 42 months, which will carry 6.20% and 6.50% interest rate respectively. Both cumulative and non-cumulative options are available for depositors to choose from.

Further, senior citizens shall be eligible for another 20 bps higher rates.

The snapshot of the rates is mentioned below for reference:

About Mahindra & Mahindra Financial Services Limited

Mahindra & Mahindra Financial Services Limited (Mahindra Finance), part of the Mahindra Group, is one of India’s leading non-banking finance companies. Focused on the rural and semi-urban sector, the Company has over 7.3 Million customers and has an AUM of over USD 11 Billion. The Company is a leading vehicle and tractor financier, provides loans to SMEs and also offers fixed deposits. The Company has 1388 offices and reaches out to customers spread over 3,80,000 villages and 7000 towns across the country.

Mahindra Finance has been ranked 25th among India’s Best Companies to Work 2020 and Ranked 54th on the list of Best Large Workplaces in Asia 2020 by Great Place to Work® Institute.

Mahindra Insurance Brokers Limited (MIBL), the Company's Insurance Broking subsidiary is a licensed Composite Broker providing Direct and Reinsurance broking services.

Mahindra Rural Housing Finance Limited (MRHFL) a subsidiary of Mahindra Finance provides loans for purchase, renovation, construction of houses to individuals in the rural and semi-urban areas of the country.

Mahindra Finance CSR Foundation is a wholly-owned subsidiary company, under the provisions of section 8 of the Companies Act, 2013 for undertaking the CSR activities of the Company and its subsidiaries.

Mahindra Manulife Investment Management Private Limited (formerly known as Mahindra Asset Management Company Private Limited) acts as the Investment Manager of Mahindra Manulife Mutual Fund (formerly known as Mahindra Mutual Fund). On 29th April 2020 Mahindra Finance divested 49% stake in its wholly-owned subsidiary, Mahindra Manulife Investment Management Private Limited to Manulife Investment Management (Singapore) Pte. Ltd. to form a 51:49 joint venture.

Mahindra Manulife Trustee Private Limited (MMTPL), (formerly known as Mahindra Trustee Company Private Limited) acts as a Trustee to Mahindra Manulife Mutual Fund (formerly known as Mahindra Mutual Fund). On 29th April 2020 Mahindra Finance divested 49% stake in its wholly owned subsidiary, Mahindra Manulife Trustee Private Limited to Manulife Investment Management (Singapore) Pte. Ltd. to form a 51:49 joint venture.

The Company has a Joint Venture in the US, Mahindra Finance USA LLC, in partnership with De Lage Landen, a subsidiary of Rabo Bank, for financing Mahindra vehicles in the US.

Mahindra Ideal Finance Limited (MIFL) is a subsidiary of the Company in Sri Lanka. The Company holds 58.2% equity stake in MIFL. MIFL focuses on providing a diversified suite of financial services to the Sri Lankan market.

Learn more about Mahindra Finance on www.mahindrafinance.com / Twitter and Facebook: @MahindraFin.

About Mahindra

Founded in 1945, the Mahindra Group is one of the largest and most admired multinational federation of companies with 260,000 employees in over 100 countries. It enjoys a leadership positionin farm equipment, utility vehicles, information technology and financial services in India and is the world’s largest tractor company by volume. It has a strong presence in renewable energy, agriculture, logistics, hospitality and real estate.

The Mahindra Group has a clear focus on leading ESG globally, enabling rural prosperity and enhancing urban living, with a goal to drive positive change in the lives of communities and stakeholders to enable them to Rise.

Learn more about Mahindra on www.mahindra.com / Twitter and Facebook: @MahindraRise/ For updates subscribe to https://www.mahindra.com/news-room

Media contact information

Mohan Nair

Head – Communications,

Mahindra & Mahindra Financial Services Limited

Email – [email protected]

Search Assistance

Welcome!

Mahindra Assistant is here to help with your search queries. How can we assist you today?